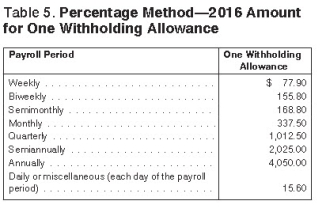

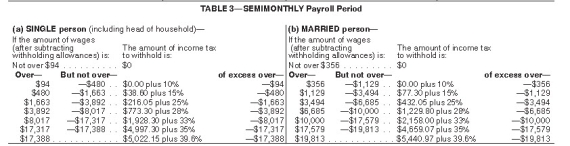

Danny is a full-time exempt employee in Alabama,where the state income tax rate is 5%.He earns $78,650 annually and is paid semimonthly.He is married with four withholding allowances.His is health insurance is $100.00 per pay period and is deducted on a pre-tax basis.Danny contributes 5% of his pay to his 401(k) .Assuming that he has no other deductions,what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax.Do not round interim calculations,only round final answer to two decimal points. )

Definitions:

Convertible Bonds

Convertible bonds are a type of debt security that can be converted into a predetermined number of the issuing company's shares, typically at the discretion of the bondholder.

Dividend Payment

The distribution of a portion of a company’s earnings to its shareholders, usually in cash or as additional stock.

Record Holders

Individuals or entities officially registered as the owners of securities or assets on the issuing company's books.

Quarterly Dividend

A dividend paid by a corporation to its shareholders every three months.

Q1: To boost demand for universal design homes,builders

Q8: A legal document authorizing someone to act

Q21: World population growth presently varies greatly from

Q22: Historic earthquakes in the Rio Grande rift

Q30: Form I-9 is issued by the _to

Q32: The two focuses of payroll procedures are

Q32: Social Security tax has a wage base,which

Q37: Paycards represent a trend in employee compensation

Q128: An estate plan is usually implemented by

Q158: One of the misconceptions about retirement is