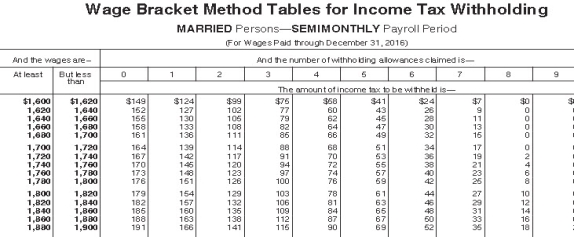

Trish earned $1,734.90 during the most recent semimonthly pay period.She is married and has 3 withholding allowances and has no pre-tax deductions.Based on the following table,how much should be withheld from her gross pay for federal income tax?

Definitions:

Periodic Inventory System

An inventory accounting system where updates to the inventory account occur at specific intervals, such as monthly or annually, rather than continuously.

Cost Of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including material and labor costs.

Gross Profit

The profit a company makes after deducting the costs associated with making and selling its products or providing its services.

Net Income

The total profit of a company after all expenses and taxes have been deducted from revenues, also known as net earnings or net profit.

Q1: The acceleration due to gravity is 9.8

Q5: Using the rule of 70,a population growth

Q15: The time needed for a typical atom

Q23: Employment legislation during the 1930s included which

Q47: Which of the following states has the

Q51: As of 2010,what is the maximum yearly

Q58: Maeisha works for Brown Corporation,where she earns

Q71: The _ wave travels fastest and moves

Q74: The stated dollar amount will allow you

Q84: The 17 January 1994 Northridge earthquake in