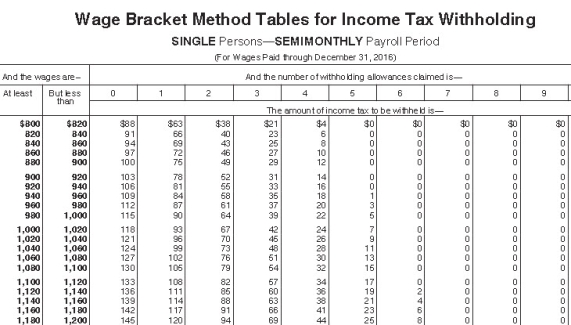

Julio is single with 1 withholding allowance.He earned $1,025.00 during the most recent semimonthly pay period.He needs to decide between contributing 3% and $30 to his 401(k) plan.If he chooses the method that results in the lowest taxable income,how much will be withheld for federal income tax (based on the following table) ?

Definitions:

Cash Flow Estimate

An assessment of the amount of money expected to flow in and out of a business over a specific period.

Marginally Profitable

Describes a business or investment that generates a slight profit above its break-even point.

Capital Gain

The profit earned from the sale of an asset when the selling price exceeds its purchase price.

Book Value

The net asset value of a company, calculated as total assets minus intangible assets (patents, goodwill) and liabilities.

Q11: The biggest shaking event is called "the

Q13: Which of the following represents evidence for

Q21: Which of the following wave types travels

Q38: Why might an employee elect to have

Q42: Water circulating at thousands of feet

Q46: An example of an accounting software package

Q58: The New Madrid,Missouri,1811-1812 earthquakes have never been

Q60: The state law sets the fees for

Q63: Naveen is a salaried nonexempt employee who

Q82: One of the advantages of a living