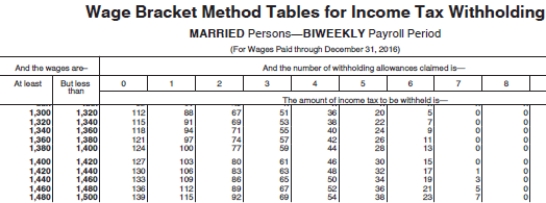

Vivienne is a full-time exempt employee in DeKalb County,Indiana,and is paid biweekly.She earns $39,000 annually,and is married with 2 withholding allowances.Her state income tax deduction is $44.46,and the DeKalb County income tax deduction is $19.62.What is the total amount of her FICA,federal,state,and local taxes per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the federal tax deduction.Do not round intermediate calculations,only round final answer to two decimal points. )

Definitions:

Gas Station

A retail establishment that sells fuel and engine lubricants for motor vehicles.

Location Services

A technology used to determine a device's current location through GPS or similar methods, often to provide personalized services or information.

SMS

Short Message Service, a text messaging service component of most telephone, internet, and mobile-device systems allowing the exchange of short text messages.

Intrabusiness Applications

Software and systems used within a business to facilitate operations, manage resources, and enhance internal communication and workflows.

Q12: What is an advantage of direct deposit

Q29: Earthquake intensity scales such as the Modified

Q32: Each year,the Earth is shaken by millions

Q38: The difference between a world population in

Q44: Cole is a minimum wage employee in

Q45: During a divorce,pension benefits are generally divided

Q53: McBean Farms has the following information on

Q56: Estate planning is useful only to rich

Q117: Which one of the following expenditures for

Q136: Your expenses for leisure activities will probably