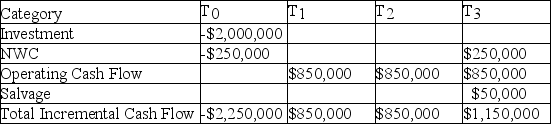

Your firm has an average-risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 9.00%, the cost of preferred stock is 12.00%, the cost of common stock is 16.00%, and the WACC adjusted for taxes is 14.00%, what is the NPV of the project, given the expected cash flows listed here?

Definitions:

Illegal Immigrants

Individuals who enter or reside in a country without proper authorization or have overstayed their visa.

Lower Costs

A reduction in the expenses associated with producing or acquiring goods and services.

Welfare System

A government program designed to support individuals and families in need through financial aid, healthcare, and social services.

Benefits

Advantages or gains provided by a product, service, or activity to an individual, group, or society.

Q13: The textbook provides a history of returns

Q18: If the SBA makes a loan guarantee,

Q49: The _ method is simple and fast

Q50: A firm is considering four projects with

Q50: The larger the variance, the smaller the

Q54: _ may be defined as a measure

Q61: With an unlimited amount of funds, a

Q74: The _ model determines at what point

Q85: What could happen to "unused" dollars after

Q85: Commercial paper has a minimum denomination of