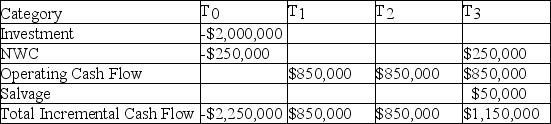

Your firm has an average-risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 9.00%, the cost of preferred stock is 12.00%, the cost of common stock is 16.00%, and the WACC adjusted for taxes is 14.00%, what is the IRR of the project given the expected cash flows listed here? Use a financial calculator to determine your answer.

Definitions:

Total Cost

The market value of the inputs a firm uses in production.

Marginal Cost

The supplementary cost that comes with the creation of one more unit of a product or service.

Perfectly Competitive

A market structure characterized by a large number of small firms, a homogeneous product, and free entry and exit, leading to price taking behavior.

Total Revenue

The total income received by a company or organization from its normal business activities, usually from the sale of goods and services to customers.

Q5: Which of the items below is sometimes

Q11: Estimating _ is one part of managing

Q12: Two techniques for determining the cost of

Q25: The cost of retained earnings _.<br>A) is

Q30: Jayhawker Inc. uses the sales forecast to

Q30: Your firm has an average-risk project under

Q38: Once financial statements are made public, the

Q71: Swale Circuit Boards, located in Montana, has

Q72: To get the operating cash flow, given

Q80: A company's cash sales in January are