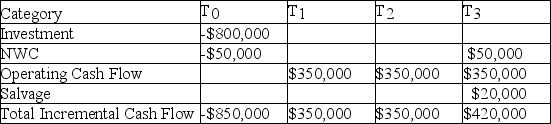

Your firm has an average-risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 9.50%, the cost of preferred stock is 10.00%, the cost of common stock is 12.00%, and the WACC adjusted for taxes is 11.50%, what is the NPV of the project, given the expected cash flows listed here?

Definitions:

Q14: The revenue is $10,000, the cost of

Q40: Products, but not services, need to be

Q44: Amalgamated Appliance Inc has planned a 3-month

Q56: Which of the statements below is FALSE?<br>A)

Q57: The ability to add debt financing to

Q63: For your firm's initial public offering of

Q66: Jensen Wholesalers has a $150,000 compensating balance

Q88: Which of the following is an advantage

Q89: Pricing preferred stock is most similar to

Q89: The EBIT is $20,000, depreciation is $5,000,