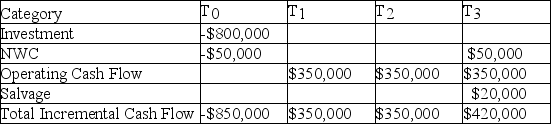

Your firm has an average-risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 9.50%, the cost of preferred stock is 10.00%, the cost of common stock is 12.00%, and the WACC adjusted for taxes is 11.50%, what is the IRR of the project, given the expected cash flows listed here? Use a financial calculator to determine your answer.

Definitions:

Biologically Opposite

Referring to organisms or traits that are fundamentally different in biological structure, function, or characteristics.

Social Categories

Classifications of individuals based on shared characteristics or attributes which can encompass race, gender, age, etc.

Genetic Differences

Variations in the genes among individuals or populations, contributing to diversity in physical traits, susceptibilities to diseases, and other characteristics.

Race

Race is a social construct that categorizes people based on physical characteristics such as skin color, geographical ancestry, and cultural affiliation, often with profound social and political implications.

Q14: The return to the investor is the

Q15: Banks and other lending institutions _.<br>A) frown

Q16: The more _ used, the greater the

Q30: Ventures that have low burn or bleed

Q32: _ is a general term applied to

Q32: If two investments have the same expected

Q48: An example of a financial statement is

Q67: Amistad Inc manufactures custom golf clubs and

Q74: BarnBurner Music, a music publishing firm located

Q98: Which of the statements below is FALSE?<br>A)