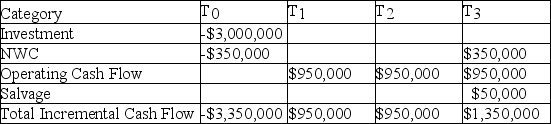

Your firm has an average-risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 11.00%, the cost of preferred stock is 12.00%, the cost of common stock is 17.00%, and the WACC adjusted for taxes is 15.00%, what is the NPV of the project, given the expected cash flows listed here?

Definitions:

Strategic Control

An attempt to make sure that strategies are well implemented and that poor strategies are scrapped or modified.

Top Management

The highest tier of executives and decision-makers in an organization, responsible for setting strategic directions and policies.

Middle Management

A level of management in an organization that is below top executives and above frontline employees, responsible for implementing company policies and strategies.

Focus Strategy

A strategy that concentrates on serving a unique market segment better than anyone else.

Q4: Perfect Purchase Electronics Selected Income Statement Items,

Q8: Which of the following classifications of securities

Q34: A line of credit is a secured

Q49: Randy's Ranch House Café has an adjusted

Q56: Beta is _.<br>A) a measure of systematic

Q74: The textbook labels preferred stock as "hybrid

Q84: To be considered acceptable, a project must

Q84: A firm is considering purchasing an asset

Q88: Which of the following is NOT typically

Q110: You wish to diversify your single-security portfolio