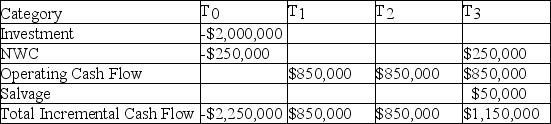

Your firm has an average-risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 9.00%, the cost of preferred stock is 12.00%, the cost of common stock is 16.00%, and the WACC adjusted for taxes is 14.00%, what is the IRR of the project given the expected cash flows listed here? Use a financial calculator to determine your answer.

Definitions:

Null Hypothesis

A statistical hypothesis that assumes no significant difference or effect exists between certain datasets or populations being compared.

High School GPA

An average score representing a high school student's academic performance, usually on a 4.0 scale.

F-Ratio

Statistic used to test differences between group means.

α

In statistics, α (alpha) typically denotes the level of significance, the probability of rejecting the null hypothesis when it is true.

Q7: The primary benefit of diversification is:<br>A) an

Q9: Which of the following would be classified

Q25: The cost of retained earnings _.<br>A) is

Q54: _ may be defined as a measure

Q60: Two different individuals or companies can go

Q60: With energy costs greater than ever, Berwick's

Q63: When looking at the history of returns,

Q64: _ is the order quantity that minimizes

Q78: Stock A B C D Expected Return

Q89: Treasury notes and bonds are zero-coupon bonds