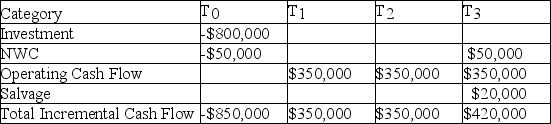

Your firm has an average-risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 9.50%, the cost of preferred stock is 10.00%, the cost of common stock is 12.00%, and the WACC adjusted for taxes is 11.50%, what is the NPV of the project, given the expected cash flows listed here?

Definitions:

Swap Contract

An agreement by two parties to exchange, or swap, specified cash flows at specified intervals in the future.

Currencies

Forms of money that are issued by governments and used as a medium of exchange for goods and services in economic transactions.

Interest Rates

The percentage charged on the total amount borrowed or earned, reflecting the cost of borrowing or the yield on investments.

Commodities

Raw materials or primary agricultural products that can be bought and sold.

Q19: Describe three of the six decision models

Q25: Termination is the process of "expiring" the

Q48: Ready Tees, an on line retailer of

Q50: The initial decision of what products and

Q63: Below the break-even EBIT, the owners can

Q73: Generally speaking, when the information is available,

Q77: Float, from the buyer's perspective, is called

Q88: When estimating the annual growth rate of

Q91: The correlation coefficient, a measurement of the

Q105: Which of the following classifications of securities