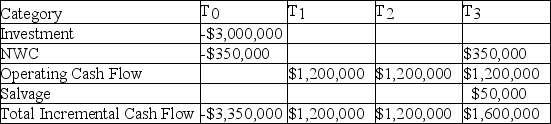

Your firm has an average-risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 11.00%, the cost of preferred stock is 12.00%, the cost of common stock is 17.00%, and the WACC adjusted for taxes is 15.00%, what is the IRR of the project, given the expected cash flows listed here? Use a financial calculator to determine your answer.

Definitions:

Biweekly Paycheck

A payment method where employees receive wages every two weeks, resulting in 26 paychecks per year.

Compounded Monthly

The interest calculation method where interest is added to the principal balance monthly, leading to interest on interest.

Conservative Investment

An investment strategy focused on preserving capital and generating a reliable, but possibly lower, return.

Retirement Account

A financial account specifically designated for saving and investing for retirement, offering tax benefits.

Q3: Your bank has agreed to grant you

Q13: _ refers to a method of matching

Q36: Use the dividend growth model to determine

Q45: Which of the statements below is TRUE?<br>A)

Q51: The debt-to-equity ratios for Firm 1, Firm

Q56: Oregon Saw Mills Inc. has credit terms

Q60: Which of the statements below is TRUE?<br>A)

Q76: A firm has revenue of $50,000, the

Q76: Callable and putable bonds add options to

Q99: The net present value of an investment