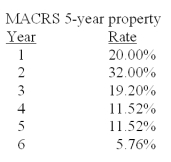

Winslow,Inc.is considering the purchase of a $225,000 piece of equipment.The equipment is classified as 5-year MACRS property.The company expects to sell the equipment after four years at a price of $50,000.What is the after-tax cash flow from this sale if the tax rate is 35%?

Definitions:

Holding Cash

The act of retaining liquid currency or cash equivalents by individuals or firms as a part of their financial strategy, to cover expenses or for speculative purposes.

Interest Rate

The percentage charged or paid for the use of money on a loan or investment, typically expressed as an annual percentage rate (APR).

Miller-Orr Model

A financial management model used to determine the optimal level of cash balance a company should maintain, considering the costs of cash management and the variability of cash flows.

Opportunity Rate

The expected rate of return on the best alternative investment option.

Q22: Over the past five years,a stock produced

Q23: What is the amount of the after-tax

Q28: A stock had returns of 8%,39%,11%,and -24%

Q28: You are considering a job offer.The job

Q40: If a firm is unlevered and has

Q40: What is the contribution margin for a

Q41: The formula for calculating beta is given

Q54: The variance of returns is computed by

Q60: Event studies attempt to measure:<br>A)the influence of

Q89: What is the effective annual rate if