Multiple Choice

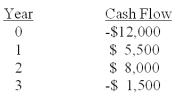

You are considering an investment with the following cash flows.If the required rate of return for this investment is 13.5%,should you accept it based solely on the internal rate of return rule? Why or why not?

Definitions:

Related Questions

Q13: Winslow,Inc.stock is currently selling for $40 a

Q17: Interest rates or rates of return on

Q73: A project has a contribution margin of

Q90: Forty years ago,your father invested $3,500.Today that

Q98: It will cost $2,600 to acquire a

Q100: Interest rate risk is often explained by

Q100: The common stock of Eddie's Engines,Inc.sells for

Q109: The financial ratio measured as total assets

Q115: The financial ratio measured as net income

Q123: The long-term bonds issued by state and