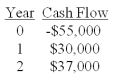

You would like to invest in the following project.  Victoria,your boss,insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted.She also insists on applying a 10% discount rate to all cash flows.Based on these criteria,you should:

Victoria,your boss,insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted.She also insists on applying a 10% discount rate to all cash flows.Based on these criteria,you should:

Definitions:

Base Year

A specific year chosen as a point of reference or benchmark for financial or economic data comparison over time.

Laspeyres Index

A measure of price inflation that calculates the relative price change of a fixed basket of goods and services at current prices compared to the prices of the same basket in a base period.

Price Levels

The overall average price of all goods and services made in the economy.

Consumption Levels

The amount of goods and services consumed by an individual or population.

Q6: The present value of future cash flows

Q26: If a firm decreases its operating costs,all

Q28: A stock had returns of 8%,39%,11%,and -24%

Q28: Which one of the following statements is

Q44: The average compound return earned per year

Q48: If the company has a discount rate

Q63: The cash ratio is measured as:<br>A)current assets

Q73: You are to receive $75 per year

Q93: Shares of common stock of the Samson

Q107: The value of a 20 year zero-coupon