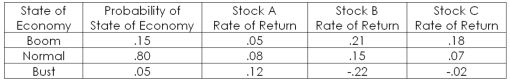

Consider the following information on a portfolio of three stocks:  The portfolio is invested 35 percent in each Stock A and Stock B and 30 percent in Stock C.If the expected T-bill rate is 3.90 percent,what is the expected risk premium on the portfolio?

The portfolio is invested 35 percent in each Stock A and Stock B and 30 percent in Stock C.If the expected T-bill rate is 3.90 percent,what is the expected risk premium on the portfolio?

Definitions:

Low-Cohesion Teams

Teams characterized by weak bonds and minimal loyalty between members, often resulting in less effective teamwork.

Self-Directed Teams

Groups of individuals who manage their own workload and operations, typically without direct supervision.

Interdependent Tasks

Work assignments or projects that require two or more individuals or groups to collaborate and rely on each other to succeed.

Calculus-Based Trust

A form of trust grounded in the expectation that others will act predictably based on past interactions and personal gain.

Q7: Greenwood Motels has filed a petition for

Q14: Lester's Dry Goods paid $1.10 per share

Q19: Venus,Inc.has an issue of preferred stock outstanding

Q44: Which one of the following is correct

Q51: Davidson Interiors declared a dividend to holders

Q53: Explain how the selection of a method

Q61: An agent who buys and sells securities

Q70: Which one of the following is an

Q78: Jim's Hardware is adding a new product

Q80: Assume that clienteles exist.Given this assumption,which one