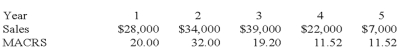

The Blue Lagoon is considering a project with a five-year life.The project requires $110,000 of fixed assets that are classified as five-year property for MACRS.Variable costs equal 71 percent of sales,fixed costs are $9,600,and the tax rate is 35 percent.What is the operating cash flow for year 4 given the following sales estimates and MACRS depreciation allowance percentages?

Definitions:

Opportunity Cost

The cost of foregone alternatives, the value of the best alternative given up when a decision is made to choose one option over another.

Ironing

the process of using a heated tool (iron) to remove wrinkles from fabric, typically garments, enhancing their appearance.

Suppliers

Individuals or businesses that provide goods or services to consumers, businesses, or other organizations.

Households

Units of residence in an economy that include all individuals who live together and make joint economic decisions.

Q3: Which one of the following has the

Q6: You own a $222,000,000 portfolio that is

Q6: Which one of the following is an

Q7: Which of the following characteristics apply to

Q11: Given the following information,what is the standard

Q32: A stock has a beta of 1.24,an

Q37: An investment has conventional cash flows and

Q47: The common stock of White's Hardware closed

Q75: Rochester,Inc.has 7,500 shares of stock outstanding at

Q100: The amount by which a firm's tax