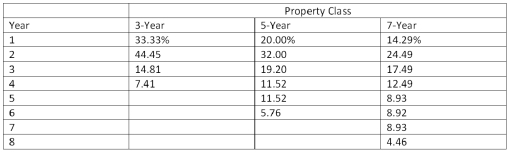

An asset used in a three-year project falls in the five-year MACRS class for tax purposes.The asset has an acquisition cost of $5.4 million and will be sold for $1.2 million at the end of the project.If the tax rate is 35 percent,what is the aftertax salvage value of the asset?  Table 9.7 Modified ACRS depreciation allowances

Table 9.7 Modified ACRS depreciation allowances

Definitions:

Financing Activities

These activities generate cash inflows and outflows related to borrowing from and repaying principal to creditors and completing transactions with the company’s owners, such as selling or repurchasing shares of common stock and paying dividends.

Common Stock

A type of equity security that represents ownership in a corporation, giving the holder a share of the corporation's profits and assets.

Cash Outflow

Money that is spent or paid out by a business or individual, resulting in a decrease in cash balance.

Financing Activities

Refers to transactions and business events affecting long-term liabilities and equity, including obtaining resources from owners and providing them with a return on their investment.

Q5: Sugar and Spice stock is expected to

Q7: The addition of a risky security to

Q8: A protective covenant:<br>A)protects the borrower from unscrupulous

Q27: Slaughter Industries just signed a sales contract

Q29: Which one of the following analytical methods

Q31: Business Solutions,Inc.is expected to pay its first

Q40: Inside quotes are defined as the:<br>A)bid and

Q79: Investors require a 4 percent return on

Q84: The price at which an investor can

Q100: Which one of the following statements is