Multiple Choice

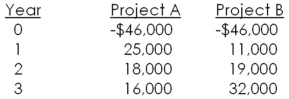

You are considering the following two mutually exclusive projects.The required return on each project is 14 percent.Which project should you accept and what is the best reason for that decision?

Definitions:

Related Questions

Q9: The 8 percent,$1,000 face value bonds of

Q18: Mary owns 100 shares of stock.Each share

Q24: Explain the relationships among the reward-to-risk ratio,risk-free

Q43: Which one of the following is generally

Q57: The risk premium for an individual security

Q59: One year ago,LaTresa purchased 600 shares of

Q65: A project has expected cash inflows,starting with

Q76: Which one of the following is the

Q88: You just received a loan offer from

Q102: A bond for which no specific property