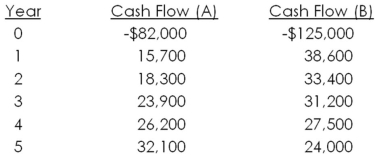

Quattro,Inc.has the following mutually exclusive projects available.The company has historically used a four-year cutoff for projects.The required return is 11 percent.  The payback for Project A is ____ while the payback for Project B is ____.The NPV for Project A is _____ while the NPV for Project B is ____.Which project,if any,should the company accept?

The payback for Project A is ____ while the payback for Project B is ____.The NPV for Project A is _____ while the NPV for Project B is ____.Which project,if any,should the company accept?

Definitions:

Manufacturing Costs

The total costs involved in making products which can include direct materials, direct labor, and manufacturing overhead.

Direct Material

These are the raw materials and components that are consumed directly in the manufacture of a product.

Variable Overhead

Costs that vary in total in direct proportion to changes in activity level or volume, such as utility costs or raw materials that fluctuate with production levels.

Factory Depreciation

The decrease in value of manufacturing equipment and facilities over time due to wear and tear or obsolescence.

Q13: A stock has an expected return of

Q18: The net present value:<br>A)decreases as the required

Q34: The Texas Instruments Company has 9 percent

Q38: Industrial Services is analyzing a proposed investment

Q56: Jeff deposits $3,000 into an account which

Q61: Bermuda Cruises issues only common stock and

Q61: You are considering the following two mutually

Q73: Derek's is a brick-and-mortar toy store.The firm

Q88: Which one of the following is the

Q103: You own two bonds.Both bonds pay annual