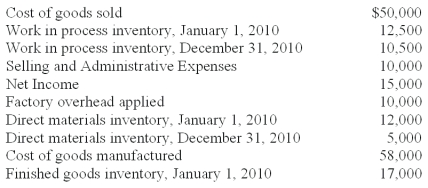

Fisher,Inc.recently lost a portion of its records in an office fire.The following information was salvaged from the accounting records.

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount of net sales?

Definitions:

Cost Assignment

The process of identifying, aggregating, and assigning costs to cost objects, such as products, services, or departments.

Plantwide Overhead Rate

A single overhead rate calculated by dividing total factory overhead by the total amount of a chosen allocation base, applied uniformly across all production.

Activity-based Costing (ABC)

A costing method that assigns overhead and indirect costs to related products and services based on their usage.

Overhead Rates

The ratio used to allocate indirect costs to products or services, usually based on direct labor hours, machine hours, or direct labor cost.

Q1: The mathematical technique that underlies the reciprocal

Q15: A time ticket:<br>A)Shows the time an employee

Q16: When cost relationships are linear,total variable costs

Q19: Which of the following has the weakest

Q35: Describe a "mutual gains" situation.

Q39: Elimination of low-value-added activities in a firm

Q42: The Insurance Plus Company has two service

Q42: National Inc.manufactures two models of CMD that

Q44: The decline of the U.S.dollar relative to

Q81: ABC Company listed the following data for