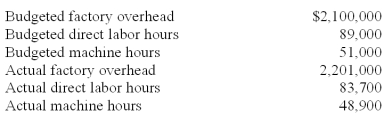

Sutherland Company listed the following data for 2010:

Assuming Sutherland applied overhead based on direct labor hours,the company's predetermined overhead rate for 2010 is (round to two significant digits) :

Definitions:

Income From Continuing Operations

The earnings generated from a company's ongoing core business operations, excluding extraordinary items.

Cumulative Effect

The aggregate impact of an accounting change or policy adjustment over the period before the adjustment is implemented, often recognized immediately in financial statements.

Income Tax Expense

The amount of money that companies or individuals owe the government based on their earnings.

Disposal Of A Segment

The act of selling, disposing of, or eliminating a certain portion or division of a company's operations.

Q12: Parties feel better about a settlement when

Q24: Assume the following information pertaining to Moonbeam

Q49: A party changing his or her position

Q63: Customer Profitability Analysis Spring Company collected the

Q69: The Sakicki Manufacturing Company has two service

Q72: Which equation correctly calculates the total weighted

Q78: How can a negotiator abandon a committed

Q81: Tierney Construction,Inc.recently lost a portion of its

Q82: In least squares regression analysis,the cost to

Q124: Nerrod Company sells its products at $500