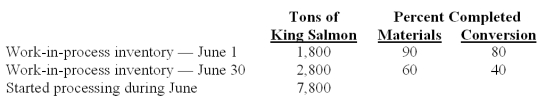

Oregonian Fisheries Inc.processes king salmon for various distributors.Two departments are involved - processing and packaging.Data relating to tons of king salmon processed in the processing department during June 2010 are provided below:

The journal entry to record requisitioned and used direct materials would include a credit to:

Definitions:

Cost Method

An accounting technique where investments are recorded at their original purchase cost, without adjustment for market changes unless deemed permanently impaired.

Non-controlling Interest

The portion of equity in a subsidiary not owned by the parent company, showing the equity interest in a subsidiary held by minority shareholders.

Net Income

The total profit of a company after all expenses and taxes have been deducted from revenues.

Deferred Taxes

are taxes that are accumulated due to temporary differences between the accounting income and taxable income, and will be paid or received in the future.

Q2: A company allocates its variable factory overhead

Q18: A portion of the costs incurred by

Q21: All the following are characteristic of relevant

Q23: A strategy map is:<br>A)A detailed flowchart outlining

Q44: How does decreased communication contribute as one

Q55: The five steps for strategic decision making

Q61: James Automotive Group is a maker of

Q67: Departmental overhead rates are preferred over plantwide

Q79: Zing Inc.calculates cost for an equivalent unit

Q87: Shaver Co.manufactures a variety of electric razors