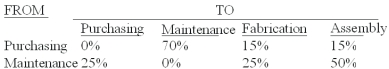

The Sakicki Manufacturing Company has two service departments - purchasing and maintenance,and two production departments - fabrication and assembly.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs) were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the assembly department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar) :

Definitions:

Preferred Provider Organization

Preferred Provider Organization (PPO) is a type of health insurance plan that offers a network of healthcare providers, allowing policyholders to receive services at a discounted rate.

Health Maintenance Organization

A type of health insurance plan that typically restricts patients to a network of doctors and hospitals in order to control costs.

Exclusive Provider Organization

A managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network, except in an emergency.

Primary Care Physician

A healthcare provider who acts as the first point of contact for patients, offering general medical care and referring to specialists when necessary.

Q21: The Insurance Plus Company has two service

Q32: Which of the following five steps (out

Q36: Which of the following statements concerning value

Q39: List factors that should be considered in

Q43: The Sand Cruiser is a takeout food

Q45: Cost allocation of shared facilities cost is

Q50: The independent variable in regression analysis is:<br>A)The

Q52: A comprehensive or overall formal plan for

Q66: General Manufacturing expects to have 40,000 pounds

Q143: The cost of sales visits is a:<br>A)Customer