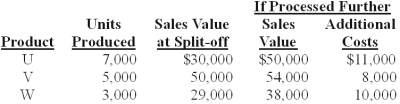

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product U using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar) :

Definitions:

Farmer

An individual engaged in agriculture, raising living organisms for food or raw materials, typically leading the operation of farms or animal husbandry.

Price

The amount of money required to purchase a good or service.

Average Price

The sum of all the prices of all the units sold divided by the number of units.

Return

The gain or loss on an investment over a specified period, expressed as a percentage of the investment's initial cost.

Q5: The learning curve in cost estimation is

Q32: Roussey Co.had the following information for the

Q54: Orange,Inc.has identified the following cost drivers for

Q55: Which is not a common method used

Q67: The Car Lot is a New York

Q69: Which of the following is the percentage

Q70: Which of the following best describes a

Q73: The process of examining how a change

Q85: The Sand Cruiser is a takeout food

Q87: NUV Company manufactures products to customer specifications.A