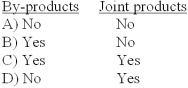

For the purposes of cost accumulation,which of the following are identifiable as different individual products before the split-off point?

Definitions:

Markup

The amount added to the cost of goods to determine their selling price, typically expressed as a percentage of the cost.

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead costs to products, calculated at the beginning of the period.

Selling Price

The amount of money charged for a product or service, determined by factors such as cost, market demand, and competition.

Unit Product Costs

Unit product costs are the total expenses incurred in producing a single unit of product, including direct materials, direct labor, and manufacturing overhead, crucial for pricing and profitability analyses.

Q11: Relative sales value at split-off is used

Q16: When cost relationships are linear,total variable costs

Q18: A portion of the costs incurred by

Q21: The standard error of the estimate (SE)in

Q25: Russell Co.produces three products - U,V,and W

Q38: Which of the following is not used

Q48: Which of the following industries is more

Q60: One of the behavioral problems with relevant

Q94: Everlast Co.manufactures a variety of drill bits.The

Q124: Nerrod Company sells its products at $500