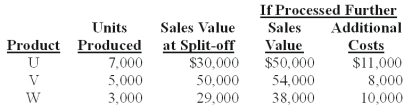

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product W using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar) :

Definitions:

Adjusted Basis

The net cost of an asset after adjusting for various tax-related items, such as improvements and sales.

Fair Market Value

The estimated price an asset would fetch in the marketplace, subject to the willingness of both buyer and seller.

Recognized Loss

A loss on an investment that has been sold for less than its purchase price, which can be used to offset capital gains for tax purposes.

Publicly Traded

Refers to companies whose shares are bought and sold by the public on stock exchanges.

Q12: Beckner Inc.is a job-order manufacturer.The company uses

Q13: Jackson Inc.listed the following data for 2010:

Q21: The Insurance Plus Company has two service

Q27: Standard costs are:<br>A)Planned costs the firm should

Q35: Enterprise Tax Services (ETS)provides tax planning.The company

Q41: The following information applies to the Johnson

Q70: A plan showing the units of goods

Q70: Which one of the following records and

Q80: The common element among the firms Nike,GM,and

Q97: Quirch Inc.manufactures machine parts for aircraft engines.The