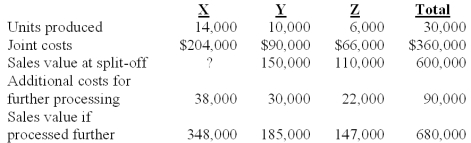

Walman Corp.manufactures products X,Y,and Z from a joint process.Joint costs are allocated on the basis of relative sales value at the split-off point.Additional information is as follows:

Product X's sales value at split-off is:

Definitions:

Overhead Cost

Expenses related to the operation of a business that are not directly tied to a specific product or service, such as rent, utilities, and administrative salaries.

Activity Cost Pool

A grouping of all the costs related to a particular business activity, facilitating more accurate allocation of overhead costs to products or services.

Machining

The process of removing material from a workpiece to shape or finish it using machine tools, typically in a manufacturing or engineering setting.

Unit-level Activity

Pertains to the activities or actions that vary directly with the number of units produced or services delivered.

Q1: A manufacturer planned to use $82 of

Q7: A concept which is commonly employed with

Q20: Shoemaker Perkins Company uses a standard cost

Q22: Management accountants are frequently asked to analyze

Q35: Lens Care Inc.(LCI)manufactures specialized equipment for polishing

Q60: Which of the following can use cost/volume/profit

Q62: A company using regression analysis to correlate

Q89: The journal entry to record incurred direct

Q95: The value chain analysis used in connection

Q147: By convention,short-term financial control is accomplished by