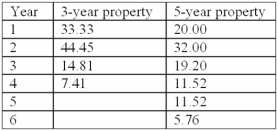

Marc Corporation wants to purchase a new machine for $400,000.Management predicts that the machine can produce sales of $275,000 each year for the next 5 years.Expenses are expected to include direct materials,direct labor,and factory overhead (excluding depreciation) totaling $80,000 per year.The company uses MACRS for depreciation.The machine is considered as a 3-year property and is not expected to have any significant residual at the end of its useful years.Marc's income tax rate is 40%.Management requires a minimum of 10% return on all investments.A partial MACRS depreciation table is reproduced below.

What is the after-tax cash inflow in Year 1 from the investment (rounded to the nearest thousand) ?

Definitions:

Marginal Revenue Curve

A graphical representation showing the additional revenue a firm can earn by selling one more unit of a good or service.

Marginal Profit

The additional profit earned from selling one more unit of a product or service.

Marginal Revenue

The incremental profit made from the sale of an additional unit of a good or service.

Marginal Cost

The increment in overall expenses due to the output of one more unit of a product or service.

Q2: To achieve the target cost,Lens Care plans

Q4: Winona Johnson is the president of Johnson

Q17: Miller has the following information pertaining to

Q41: Concurrent engineering relies on an integrated approach,in

Q49: Ken Yalters,the COO of FreshSkin,asked his cost

Q84: The following information is available from the

Q118: Allmakes Software budgeted August purchases of new

Q123: All of the following are ways of

Q130: Kennedy Inc.has the following data for its

Q145: All of the following are limitations of