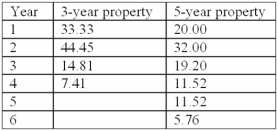

Marc Corporation wants to purchase a new machine for $400,000.Management predicts that the machine can produce sales of $275,000 each year for the next 5 years.Expenses are expected to include direct materials,direct labor,and factory overhead (excluding depreciation) totaling $80,000 per year.The company uses MACRS for depreciation.The machine is considered as a 3-year property and is not expected to have any significant residual at the end of its useful years.Marc's income tax rate is 40%.Management requires a minimum of 10% return on all investments.A partial MACRS depreciation table is reproduced below.

What is the after-tax cash inflow in Year 1 from the investment (rounded to the nearest thousand) ?

Definitions:

Lost Profits

The potential revenue that a business did not earn due to an interruption, disruption, or another adverse event.

Resale

The act of selling an asset or item that was previously purchased, often occurring in secondary markets or through distributor networks.

Breaches

Incidents where laws, contracts, or promises are violated, leading to legal consequences.

Compensatory Damages

Financial reparations awarded to a plaintiff to compensate for loss, injury, or harm suffered due to the defendant's actions.

Q13: The Car Lot is a New

Q16: Pokeman Bunch Inc. ,manufactures PokeMonster figures and

Q26: The term "breakeven after-tax cash flow" represents:<br>A)A

Q28: The Car Lot is a New York

Q51: Authoritative standards (within the context of a

Q56: Lucky Company's direct labor information for the

Q59: Which of the following is a characteristic

Q66: For product-costing purposes,which of the following statements

Q86: Motor Corp.manufactures machine parts for boat engines.The

Q110: Olsen Inc.purchased a $600,000 machine to manufacture