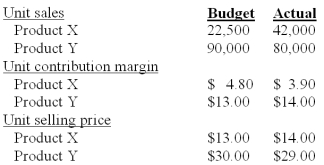

Jackson,Inc manufactures two products that it sells to the same market.Excerpted below are its budgeted and actual operating results for the year just completed:

Industry volume was estimated to be 1,875,000 units at the time the budget was prepared.Actual industry volume for the period was 2,440,000 units.Jackson measures variances using contribution margin.If fixed costs are budgeted for $500,000 and are actually $500,000,what is the difference between budgeted and actual operating income?

Definitions:

Work In Process Inventory

Goods partially completed in the manufacturing process, not yet ready for sale.

Units Transferred Out

The complete quantity of units that have moved through a production process and are sent out from a specific department or the entire production system.

Processing Department

A section within a manufacturing facility where specific types of operations or treatments are carried out on products.

First-In, First-Out Method

An inventory valuation method where the first items purchased or produced are the first ones sold, affecting the cost of goods sold and ending inventory value.

Q1: Megan,Inc.uses the following standard costs per unit

Q20: Shoemaker Perkins Company uses a standard cost

Q22: Warrenton Industries manufactures hydraulic components for large

Q45: Hyland Company manufactures generic products for several

Q55: A company's operating income was $70,000 using

Q57: In terms of allocating fixed overhead cost

Q59: Landlubber Company has established a standard direct

Q60: What is the reasoning behind the misconception

Q77: James has the following information pertaining to

Q93: For production and support departments,a method of