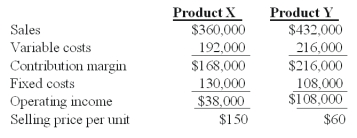

Winston Co.had two products code named X and Y.The firm had the following budget for August:

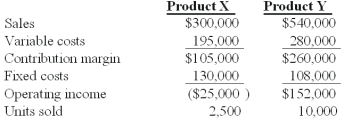

On September 1,the following operating results for August were reported:

Industry volume was estimated to be 120,000 units at the time of the budget.Actual industry volume for the period was 125,000 units.

The firm's total sales quantity variance for the period is:

Definitions:

FICA Tax

The Federal Insurance Contributions Act (FICA) tax is a United States federal payroll tax imposed on both employees and employers to fund Social Security and Medicare programs.

Incidence

The analysis of the distributional effect of a tax or policy on different groups, focusing on who bears the cost.

Tax Imposed

A financial charge levied by a government on individuals, corporations, or goods to fund public expenditures.

Elasticity of Supply

A measure of how much the quantity supplied of a good changes in response to a change in price.

Q11: Which of the following is not a

Q35: A partial operational productivity measure:<br>A)Uses physical units

Q55: Place the five steps in implementing a

Q66: Precilla Company uses a standard costing system

Q102: The manager acting independently in such a

Q111: Bike Pedals manufactures bicycle seats.The company budgeted

Q114: One advantage of the return on investment

Q125: Which of the following statements regarding

Q140: Megan,Inc.uses the following standard costs per unit

Q150: Which of the following statements is correct?<br>A)Random