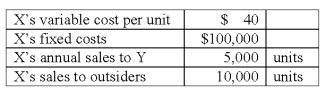

A company has two divisions,X and Y,each operated as an investment center.X charges Y $55 per unit for each unit transferred to Y.Other data are:

X is planning to raise its transfer price to $65 per unit.Division Y can purchase units at $50 each from outsiders,but doing so would idle X's facilities now committed to producing units for Y.Division X cannot increase its sales to outsiders.From the perspective of the short-term profit position of the company as a whole,from whom should Division Y acquire the units?

Definitions:

FIFO

FIFO (First-In, First-Out) is an inventory valuation method where goods first purchased or produced are the first ones sold.

Periodic

Occurring or repeating at regular intervals.

Inventory Record

Documentation that tracks the quantities and value of products a company holds for sale.

Social Learning Theory

Posits that people learn attitudes, beliefs, and behaviors through social interaction.

Q41: Discuss how the group definition of who

Q54: Jackson Manufacturing has the following operating results

Q72: Best Brand Inc.(BBI)manufactures household goods in the

Q74: The variances discussed in Chapter 15 (for

Q79: A tool that identifies potential causes of

Q93: For production and support departments,a method of

Q93: Gourmet Aroma Coffee House has an exclusive

Q94: The two major contributing factors to a

Q97: Gutsen Communications Inc.manufactures a scrambling device for

Q106: A key standard in international transfer pricing