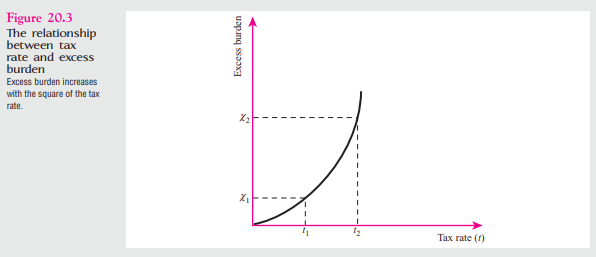

-Refer to Figure 20.3.Suppose the equation that equates excess burden to the tax rate can be written as EB = t2,where EB is excess burden and t is the tax rate.

(A)Suppose the tax rate t is initially 12 percent.How much excess burden is generated?

(B)If the tax rate doubles to 24 percent,what happens to excess burden?

Definitions:

Nominal Interest Rates

Interest rates that have not been adjusted for inflation, reflecting the rate of interest paid by borrowers or earned by investors.

Pure Discount Securities

Financial instruments that are sold at a discount from their face value and pay no interest until maturity, such as zero-coupon bonds.

Clean Price

The price of a bond excluding any interest that has accrued since issue or during the last coupon payment.

Dirty Price

The price of a bond that includes accrued interest, in contrast to the clean price which excludes it.

Q4: Negative externalities cause loss of welfare not

Q5: The Haig-Simons definition of income includes<br>A)employer pension

Q5: Enrollment in the Medicaid program<br>A)is designed for

Q9: Carve-out accounts<br>A)applies only to workers between 65

Q15: Residential housing consumption is not affected by

Q24: Discuss the ethics of Milgram's study.

Q25: An industry where the capital-labor ratio is

Q25: There is no correlation between more years

Q29: For the last 100 years,the level of

Q53: In order to determine whether or not