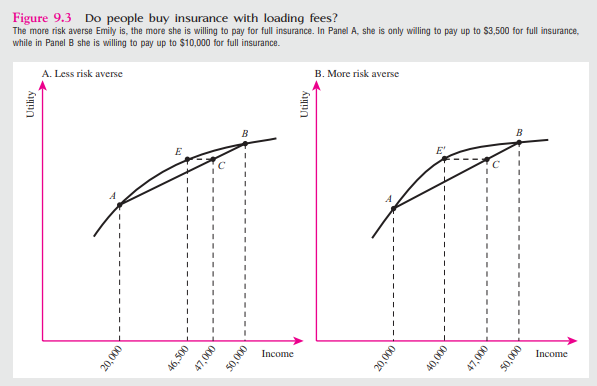

-In Figure 9.3,Panel B,$40,000 for certain is as desirable as $47,000 with risk.

Definitions:

LIFO

"Last In, First Out," an inventory valuation method where the most recently produced or acquired items are the first to be expensed.

Gross Profit

The difference between sales revenue and the cost of goods sold, indicating how efficiently a company produces or buys its products.

Ending Inventory

The quantity and monetary value of unsold goods that a company has at the end of an accounting period, to be carried over as the beginning inventory of the next period.

FIFO

First-In, First-Out, an inventory management and valuation method where goods produced or acquired first are sold or used first.

Q2: Expenditures,as a percentage of GDP for the

Q2: Which of the following statements is true

Q6: Consumption taxes are generally viewed as<br>A)regressive.<br>B)progressive.<br>C)simple to

Q6: Refer to Figure 15.5.Suppose that the demand

Q8: The 'efficiency perspective' of Positive Accounting Theory

Q20: The prescription drug benefit plan was added

Q21: A linear income tax schedule is known

Q21: Lump sum grants are sometimes referred to

Q32: Externalities can be produced by _,as well

Q37: The degree to which an experiment is