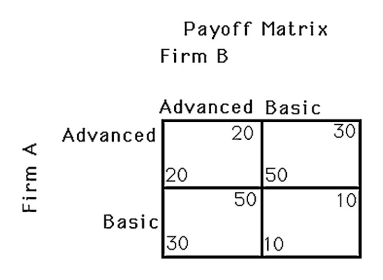

-The above figure shows the payoff matrix for two firms,A and B,choosing to produce a basic computer or an advanced computer.The dominant strategy for firm A is

Definitions:

Net Present Value

A method used in capital budgeting to evaluate the profitability of an investment or project, calculating the difference between the present value of cash inflows and outflows.

Present Value Index

A calculation that compares the present value of cash inflows to the initial investment, often used in capital budgeting.

Compound Interest

The calculation of interest on the initial principal and also on the accumulated interest of previous periods.

Average Rate of Return

A method of determining the profitability of an investment by dividing the average annual profit by the initial investment cost.

Q9: The above figure shows the demand and

Q10: Which of the following models results in

Q17: A general-equilibrium analysis of a price change

Q39: Explain why a government may select an

Q42: A public good in which exclusion is

Q56: A risk-neutral person will invest in a

Q64: The above figure shows the payoff matrix

Q80: Competition results in the efficient product mix

Q103: If the price of a competitive firm's

Q136: Since a monopoly can set any price