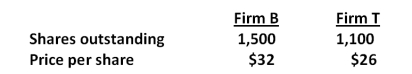

Consider the following premerger information about a bidding firm (Firm B) and a target firm (Firm T) . Assume that neither firm has any debt outstanding.  Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $2,600. What is the NPV of the merger assuming that Firm T is willing to be acquired for $28 per share in cash?

Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $2,600. What is the NPV of the merger assuming that Firm T is willing to be acquired for $28 per share in cash?

Definitions:

Normal Limits

A range within which standard performance, results, or conditions are considered to be within expected or acceptable boundaries.

Apical-Radial Pulse

The simultaneous measurement of the apical pulse, which is taken at the apex of the heart, and the radial pulse, taken at the wrist, to detect any difference or discrepancy between the two.

Pulse Deficit

The difference between the heart rate and the pulse rate, indicating a loss of peripheral pulses.

Heart Disease

A broad term for a range of diseases affecting the heart and blood vessels, often related to atherosclerosis or plaque buildup in the walls of the arteries.

Q6: Suppose the current spot rate for the

Q9: Penn Corp. is analyzing the possible acquisition

Q14: Diet Soda and High Caffeine are two

Q33: As long as there is asymmetric information

Q45: In the presence of asymmetric information,the only

Q45: A firm with a variable-rate loan wants

Q53: Searching the Internet for information to help

Q58: When majority rule voting is used to

Q78: Efficiency in risk bearing implies that<br>A)risk is

Q92: The above figure shows the payoff matrix