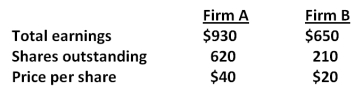

Consider the following premerger information about Firm A and Firm B:  Assume that Firm A acquires Firm B via an exchange of stock at a price of $25 for each share of B's stock. Both A and B have no debt outstanding. What will the earnings per share of Firm A be after the merger?

Assume that Firm A acquires Firm B via an exchange of stock at a price of $25 for each share of B's stock. Both A and B have no debt outstanding. What will the earnings per share of Firm A be after the merger?

Definitions:

Beta

A measure of a stock's volatility relative to the overall market, indicating its risk compared to the market average.

Risk-free Rate

The return on investment with no risk of financial loss, often represented by the yield on government securities.

CAPM

Capital Asset Pricing Model; a financial model that describes the relationship between systematic risk and expected return for assets, particularly stocks.

Beta

A measure of a stock's volatility in relation to the overall market.

Q12: Cindy's attitudes towards risk are summarized by

Q29: Company A can borrow money at a

Q33: To reduce moral hazard,a firm may<br>A)pay workers

Q52: Production inefficiency is more likely to occur

Q57: In the presence of no externalities,<br>A)social marginal

Q60: You work for a nuclear research laboratory

Q64: Suppose an agent must pay the full

Q73: What is the value of a 3-month

Q85: Which one of the following statements is

Q101: You sold ten put contracts on Cross