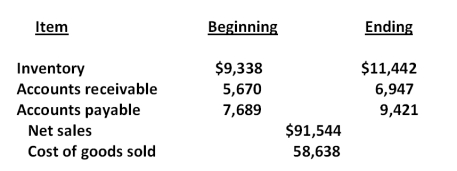

Consider the following financial statement information for the Bulldog Icers Corporation:  How long is the cash cycle?

How long is the cash cycle?

Definitions:

Average Total Costs

The total of all costs associated with production divided by the number of units produced, giving the cost per unit.

Marginal Cost

The additional expense required to produce or supply one extra unit of a product.

Fixed Costs

Costs that do not vary with the level of production or sales, such as rent, salaries, and loan payments.

Profit Maximization

A financial strategy aimed at achieving the highest possible profit level for a business by adjusting output levels, pricing, or reducing costs.

Q5: Jessica invested in Quantro stock when the

Q7: Interest rate swaps:<br>I. benefit either the buyer

Q28: Assume you are an overconfident manager. You

Q29: Suppose the spot and six-month forward rates

Q30: Which one of the following statements related

Q48: How much will you pay per pound

Q64: National Home Rentals has a beta of

Q65: Which one of the following statements is

Q71: Give an example of a situation where

Q78: The board of directors of Wilson Sporting