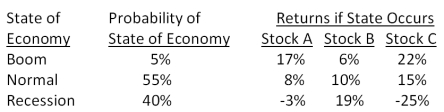

What is the standard deviation of the returns on a portfolio that is invested in stocks A, B, and C? Twenty five percent of the portfolio is invested in stock A and 40 percent is invested in stock C.

Definitions:

Long-Run Supply

The relationship between the price of a product and the quantity of the product a firm is willing to supply, considering all inputs are variable and adjusting to new market conditions over time.

Resource Supply

The total availability of resources, such as raw materials, labor, and capital, which can be used for production.

Marginal Revenue Product

The additional revenue generated by employing an additional unit of a resource, such as labor or capital.

Input Price

The cost associated with purchasing the raw materials or factors of production used in the creation of goods or services.

Q1: Which one of the following will best

Q7: The primary purpose of portfolio diversification is

Q17: McGilla Golf has decided to sell a

Q34: The average of a firm's cost of

Q41: In an effort to capture the large

Q71: An agent who arranges a transaction between

Q81: Assume that a country experiences a financial

Q83: Which one of the following statements related

Q86: Scholastic Toys is considering developing and distributing

Q87: Cantor's has been busy analyzing a new