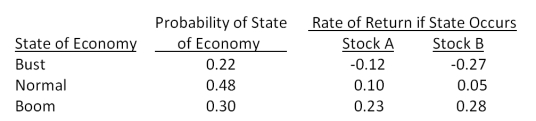

Suppose you observe the following situation:  Assume the capital asset pricing model holds and stock A's beta is greater than stock B's beta by 0.21. What is the expected market risk premium?

Assume the capital asset pricing model holds and stock A's beta is greater than stock B's beta by 0.21. What is the expected market risk premium?

Definitions:

Coupon Payments

Regular interest payments made to bondholders over the life of a bond.

Price Paid

The amount of money exchanged for the acquisition of a good, service, or asset.

Original Issue Discount

The difference between the face value of a bond and its offering price when the bond is issued at a lower price.

Semiannual Coupon

A fixed income security feature that represents the payment of interest to bondholders twice a year.

Q8: Kelley's Baskets makes handmade baskets for distribution

Q9: Which one of the following is the

Q9: Miller Sisters has an overall beta of

Q22: Which one of the following methods determines

Q53: The common stock of Auto Deliveries sells

Q53: Kelso's has a debt-equity ratio of 0.55

Q56: You currently own 600 shares of JKL,

Q68: You are evaluating a project which requires

Q77: Which one of the following statements is

Q86: Which one of the following methods of