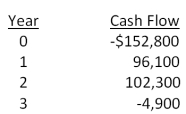

You are considering an investment with the following cash flows. If the required rate of return for this investment is 15.5 percent, should you accept the investment based solely on the internal rate of return rule? Why or why not?

Definitions:

Conversion Value

The worth of a convertible security if it is converted into a different asset, usually common stock, at the current market price.

Convertible Bond

A type of bond that can be converted into a predetermined amount of the issuing company's equity at certain times during the bond's life, usually at the discretion of the bondholder.

Common Stock

Equity ownership in a corporation, with voting rights and potential for dividends, representing a claim on part of the company’s earnings and assets.

Conversion Ratio

The specified number of shares that can be exchanged for one unit of the convertible security.

Q8: Sensitivity analysis is based on:<br>A)varying a single

Q28: Suppose you are committed to owning a

Q28: What is the expected return of an

Q40: The Blue Marlin is owned by a

Q41: What is the interest rate charged per

Q44: Samuelson Electronics has a required payback period

Q71: Today, you sold 200 shares of Indian

Q73: Stephanie is going to contribute $300 on

Q79: Phone Home, Inc. is considering a new

Q80: Systematic risk is measured by:<br>A)the mean.<br>B)beta.<br>C)the geometric