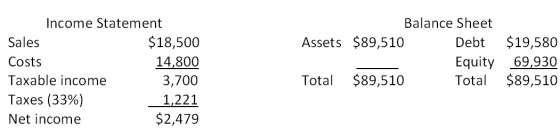

The most recent financial statements for Last in Line, Inc. are shown here:  Assets and costs are proportional to sales. Debt and equity are not. A dividend of $992 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be $21,830. What is the amount of the external financing need?

Assets and costs are proportional to sales. Debt and equity are not. A dividend of $992 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be $21,830. What is the amount of the external financing need?

Definitions:

John Kotter

A professor of leadership at Harvard Business School best known for his work on change management and leadership.

Anticipatory Socialization

The process through which individuals learn and adapt to the norms and expectations of a culture or group before they formally enter it.

Nonadaptive Organizational Culture

A company culture that struggles to adjust to new challenges, technologies, or environments, limiting progress and innovation.

Risk Taking

The act of undertaking actions or decisions that involve potential for loss or failure, typically in the hope of achieving a significant reward.

Q21: Which one of the following players on

Q35: The Equal Credit Opportunity Act makes it

Q42: Which one of the following will produce

Q52: Investment contracts are not securities.

Q54: Over the past year, the quick ratio

Q68: The Federal Hazardous Substances Act of 1960

Q73: Wise's Corner Grocer had the following current

Q88: An amortized loan:<br>A)requires the principal amount to

Q92: Identify the four primary determinants of a

Q96: What is the net capital spending for