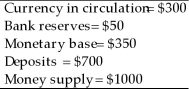

Consider an economy that has the following monetary data.  The monetary base and the money supply are expected to grow at a constant rate of 20% per year.Inflation and expected inflation are 20% per year.Suppose that bank reserves and currency pay no interest,all currency is held by the public,and bank deposits pay no interest.

The monetary base and the money supply are expected to grow at a constant rate of 20% per year.Inflation and expected inflation are 20% per year.Suppose that bank reserves and currency pay no interest,all currency is held by the public,and bank deposits pay no interest.

(a)What is the cost to the public of the inflation tax?

(b)What is the nominal value of seignorage over the year?

(c)What is the profit to the banks from the inflation?

Definitions:

Significant Influence

The power to participate in the financial and operating policy decisions of an investee without controlling those policies.

Common Stock

Equity owning in a firm that grants shareholders voting rights and a share in the company's profits, typically through dividends.

Database

A structured set of data held in a computer, especially one that is accessible in various ways, used for storing and managing information digitally.

Q7: Compare the Chesapeake and New England colonies.

Q7: Amerigo Vespucci<br>A)claimed Brazil for Portugal in 1500<br>B)founded

Q13: Believing that tobacco was harmful to one's

Q17: The largest source of tax receipts for

Q30: Increases in the debt-GDP ratio are primarily

Q60: Consider an economy in long-run equilibrium with

Q61: What is the Lucas critique,and why was

Q66: An adverse supply shock would directly _

Q121: During the French and Indian War, how

Q147: English Civil War