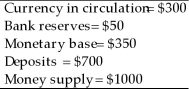

Consider an economy that has the following monetary data.  The monetary base and the money supply are expected to grow at a constant rate of 20% per year.Inflation and expected inflation are 20% per year.Suppose that bank reserves and currency pay no interest,all currency is held by the public,and bank deposits pay no interest.

The monetary base and the money supply are expected to grow at a constant rate of 20% per year.Inflation and expected inflation are 20% per year.Suppose that bank reserves and currency pay no interest,all currency is held by the public,and bank deposits pay no interest.

(a)What is the cost to the public of the inflation tax?

(b)What is the nominal value of seignorage over the year?

(c)What is the profit to the banks from the inflation?

Definitions:

Reference Variable

A variable that holds references to objects in languages like Java, unlike primitive variables that hold the data itself.

Class

A blueprint from which individual objects are created in object-oriented programming, defining a set of properties and methods applicable to all objects of that type.

Pre-defined Methods

Functions or procedures that are provided by programming languages or libraries to perform specific tasks.

Q8: According to the Taylor rule,if inflation in

Q12: How is the sacrifice ratio measured? How

Q22: In the expectations-augmented Phillips curve,π = π<sup>e</sup>

Q49: The Virginia Company can be called a

Q51: Unlike slavery in America, slavery in Africa:<br>A)

Q59: Suppose the real exchange rate is 10,the

Q61: Vasco da Gama<br>A)claimed Brazil for Portugal in

Q63: Monetary policy in the European Monetary Union

Q77: If the money multiplier is 10,the purchase

Q86: Most Keynesians suggest that the Fed<br>A)use discretion