Stan is the sole shareholder of Hardware Ltd.Hardware purchased all of the shares of Tools Inc.in 20x4 for $500,000.Tools incurred a non-capital loss of $25,000 in the year ended December 31,20x3.Stan has decided to initiate a Section 88 wind-up of Tools Inc.into Hardware Ltd.on June 23,20x7.Due to the seasonal nature of his sales,Stan would like to maintain the April 30th year end that he has used since beginning his business.

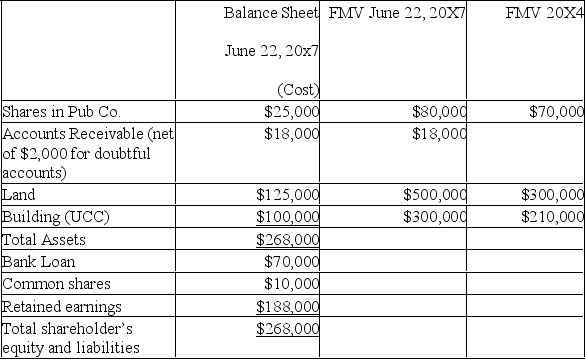

Stan's accountant has prepared the following balance sheet for Tools Inc.as of June 22,20x7.The fair market value of the assets on both June 22,20x7 and the date of acquisition in 20x4 are presented in the following table:

Tools paid dividends of $8,000 to Hardware in 20x7.

Tools paid dividends of $8,000 to Hardware in 20x7.

Required:

Answer the following questions pertaining to the wind-up of Tools Inc.into Hardware Ltd.:

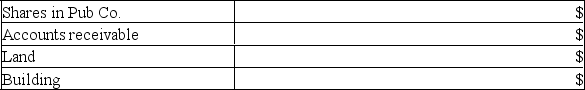

1)Hardware will be deemed to have acquired the following assets of Tools at what values?

2)Calculate the value of the section 88(1)(d)"bump" available on the ACB for the non-depreciable capital property.

2)Calculate the value of the section 88(1)(d)"bump" available on the ACB for the non-depreciable capital property.

3)Identify the assets which may use the bump,and the amount of the bump available for each asset identified.Also identify any unusable bump amount.

4)When will Hardware Ltd.be able to use the non-capital loss from Tools Inc.

Definitions:

Business Leaders

Individuals who are at the forefront of making decisions, guiding strategies, and steering the operations and future direction of a business or organization.

Plant And Equipment

are tangible assets used in the operation of a business, including machinery, buildings, and vehicles.

Future Sales

Future sales refer to the projected revenue or the volume of goods and services a business expects to sell during a future period.

Recession

A period of temporary economic decline during which trade and industrial activities are reduced, generally identified by a fall in GDP in two successive quarters.

Q11: Assume the United States has only one

Q38: If the Irish pound declines in value

Q40: In the National Football League,the players are

Q51: Which statement regarding the relationship between managerial

Q67: Managers who are able to see the

Q89: Which of the following is true concerning

Q89: Foreign aid can take the form of<br>A)

Q95: A jihadist called for a violent attack

Q96: The Blue Rooster is a bakery.It sells

Q114: Conceptual skills are more important to first-line