Sally earned $210,000 during 20x8.CPP and EI were deducted from her pay,totaling $3,452,and total income tax (federal and provincial)deducted was $70,000.She also received eligible dividends in the amount of $10,000.She sold shares in a public corporation during the year and recognized a capital gain of $500,000.Sally is married.Her husband earned $100,000 during the year.

Required:

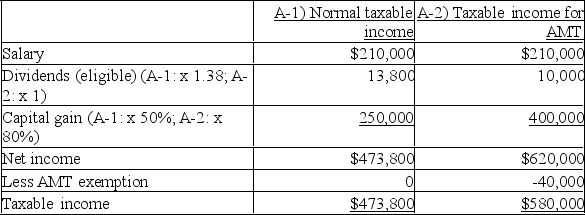

A)Calculate Sally's taxable income and her federal tax liability before the deduction of any allowable non-refundable tax credits using 1)the normal method,and 2)the alternative minimum tax method.

B)Which method would allow for a deduction of the dividend tax credit?

C)Which method will Sally be required to use in 20x8,and why? How much is her federal tax liability? (Use tax rates and amounts applicable for 2018.)

Definitions:

Drug Administration

The method by which a drug is taken into the body, such as orally, intravenously, or topically.

Catabolizing Drugs

The metabolic process of breaking down drugs in the body, often leading to their activation or deactivation.

Liver

A vital organ in the body responsible for detoxification, protein synthesis, and production of biochemicals necessary for digestion.

Blood Alcohol Level

A measure of the amount of alcohol present in the bloodstream, typically used to quantify the level of intoxication in an individual.

Q2: Which of the following is not a

Q4: While partnerships and joint ventures have some

Q7: An individual has the option to receive

Q8: Agatha earned $35,000 at her job during

Q19: Siemens makes wind turbines.Carol is the executive

Q113: Which of the following statements most correctly

Q117: Suppose that U.S.incomes rise relative to British

Q147: Which of the following is not correct

Q182: All of the following are true concerning

Q202: Bank deposits denominated in Mexican pesos are