Angela Smith has owned and operated The Stationary Store for fifteen years.The company's year-end is December 31st.Angela is trying to calculate the amount of capital cost allowance that she can deduct in 20x0 and has asked for your assistance.She has provided you with the following information:

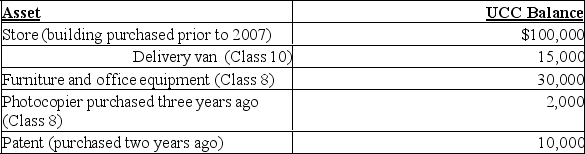

Assets owned prior to 20x0 and their UCC balances on January 1,20x0 are listed below:

Additional information for 20x0:

Additional information for 20x0:

Angela purchased $2,000 worth of small tools (each costing under $500).

She sold her delivery van for $12,000 (the original cost was $20,000),and she purchased a second-hand van for $16,000.

She installed a $15,000 air conditioning system in her building and added the cost to the standard Class 1 pool.

In December of 20x0 she sold the photocopier for $1,500 and will replace it in January,20x1 with a second-hand model valued at $1,700.

Angela amortizes the patent in Class 44.

The business acquired a franchise on March 1st of 20x0 costing $55,000.The franchise has a limited legal life of 20 years.(Ignore leap year effects.)

Required:

A)Calculate the following:

1)the total CCA that Angela will be able to claim in 20x0;

2)the UCC balances as of December 31,20x0;

3)any recapture and/or terminal loss that occurred during the year.

B)What would the tax effect have been for the original photocopier if Angela had purchased the new photocopier during 20x0?

Definitions:

Average Rate of Return

A monetary measurement for assessing an investment's profit efficiency, determined by dividing the yearly average profit by the cost of initial investment.

Cash Payback

A capital budgeting method that estimates the time required for an investment to generate cash flows sufficient to recover its initial cost.

Internal Rate of Return

A financial metric used in capital budgeting to estimate the profitability of potential investments, calculated as the discount rate that makes the net present value of all cash flows from a particular project equal to zero.

Present Value Factor

A multiplier used to calculate the present value of a future amount of money or stream of payments.

Q2: Mr.Yee sold a piece of land in

Q6: John sold a piece of land in

Q19: The current account shows international transactions in

Q23: In centrally planned economies,most prices are not<br>A)

Q38: If the Irish pound declines in value

Q46: One of the reasons that import substitution

Q62: The country of Yipi can raise its

Q132: _ is NOT one of the five

Q170: Which of the following is true?<br>A) If

Q198: A wealthy Japanese executive decides to buy