KM Ltdis a Canadian-Controlled Private Corporation,operating a Small Gift Store in in Vancouver.The

KM Ltd.is a Canadian-controlled private corporation,operating a small gift store in Vancouver.The company has a December 31st year-end.KM's financial statements reported net income before taxes of $210,000 in 20x0.

Financial information relating to 20x0 is as follows:

Land adjacent to the gift shop was purchased with a $75,000 bank loan during the year to allow for an outdoor sales area during warm weather.Interest expense on the loan for the year was $9,600,and the appraisal fee to finance the loan was $1,000.Both the interest and the appraisal fee were expensed by KM in 20x0.

The company hired a contractor to landscape the land.The $5,000 bill for the landscaping was paid in full during the year and capitalized on KM's Balance Sheet.

During the year,a new display case worth $2,000 was purchased and expensed on the books.

Amortization expense of $21,000 was deducted during the year.Total CCA (following any adjustments)for the year was $16,000,and is not reflected in the financial statements.

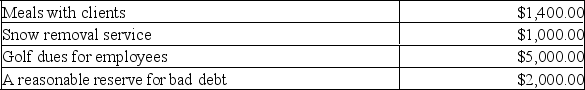

The following were also expensed during the year:

On December 30th,KM's president announced a bonus to be paid to the company's key employee in the amount of $5,000,which was expensed in the books that day.The employee will receive the bonus in 20x1 in equal payments of $2,500,to be issued on January 30th and July 30th.

On December 30th,KM's president announced a bonus to be paid to the company's key employee in the amount of $5,000,which was expensed in the books that day.The employee will receive the bonus in 20x1 in equal payments of $2,500,to be issued on January 30th and July 30th.

Required:

Determine KM Ltd.'s net income for tax purposes for 20x0.

Definitions:

Telephone Lines

Physical cables or circuits that transmit voice or data communications between different locations.

Transmission Rates

The speed at which data is transferred from one device or system to another.

Daylight Hours

The period during a day when natural light from the sun is available.

Asynchronous Meetings

Meetings where participants engage at different times according to their convenience, rather than gathering at the same time.

Q3: Angela Smith has owned and operated The

Q8: Match the following.You may use a response

Q26: Which managerial skill is likely to be

Q41: Which of the following statements about middle

Q56: Which of the following historical books did

Q107: Nipurna is a high school guidance counselor.Nipurna

Q108: Jeanne's department has the lowest production cost

Q111: If the exchange rate changes from 20

Q117: Suppose that U.S.incomes rise relative to British

Q209: Suppose the exchange rate is such that