Andy worked for High Speed Bikes Inc.from March 1st to December 31st during 20x1.He earned a monthly base salary of $4,000,plus 1% commission on all of his sales.During 20x1,Andy's sales totaled $800,000.Andy was required by his employer to pay for his employment expenses.He traveled out of his city most days in order to sell to customers in surrounding towns.He received a monthly allowance of $500 to cover his traveling costs (which has been accurately recognized as 'unreasonable').Andy and his employer each contributed $2,000 to the company's registered pension plan in 20x1

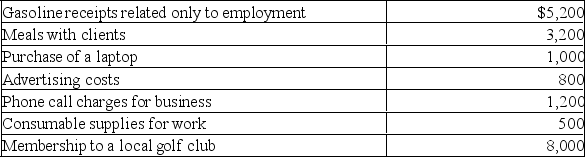

Andy provided you with the following receipts for 20x1:

Andy purchased a new vehicle for work during the year,and drove it a total of 25,000 kms while employed at High Speed Bikes.12,000 of these kilometres were for business.The vehicle cost Andy $32,000 plus GST of 5% and PST of 5%.Work-related interest payments on the car loan totaled $200 per month.

Andy purchased a new vehicle for work during the year,and drove it a total of 25,000 kms while employed at High Speed Bikes.12,000 of these kilometres were for business.The vehicle cost Andy $32,000 plus GST of 5% and PST of 5%.Work-related interest payments on the car loan totaled $200 per month.

Required:

Calculate Andy's employment income for 20x1 in accordance with Section 3 of the Income Tax Act

Definitions:

Outline

A general description or plan showing the essential features of something but without the detail.

Topics

Topics refer to the subjects or themes that are discussed or explored in a document, conversation, or area of study.

Oral Presentation

A spoken presentation or speech delivered to an audience for informative or persuasive purposes.

Complex

Composed of many interconnected parts, exhibiting varied and intricate relationships or arrangements.

Q8: Jordan was required to pay her own

Q17: History is simply a conceptual framework for

Q47: _ is(are)part of an organization's general environment.<br>A)Competitors<br>B)Owners<br>C)Partners<br>D)Unions<br>E)Technology

Q72: Which skills are most important for first-line

Q72: Everything outside an organization's boundaries that might

Q93: _ skills enable a manager to visualize

Q101: Google CEO,Larry Page,announced to the media that

Q102: If the U.S.dollar depreciates,it means that<br>A) the

Q156: Under fixed exchange rates,a central bank<br>A) adjusts

Q194: Under a fixed exchange rate system,an increase